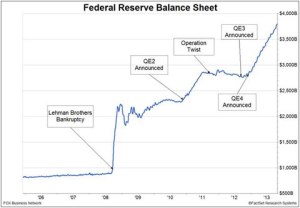

The taper has begun and unlike the expectation, the markets applauded by hitting new highs. The reality is the Fed is slowing down buying, but by very little, not enough to matter for now. The Feds balance sheet has topped 4 trillion dollars and should be close to 5 trillion by the end of 2014 unless more tapering is done throughout the upcoming year. If they do, we will see interest rates continue to rise throughout next year. This morning, we also received a revised GDP number. It shows that we grew at over 4% in the 3rd quarter, and that has gotten the economic bears to relook at our economy. Perhaps better than expected numbers come next year, as we hopefully will grow at a 3% clip. As for equities, the markets have had a very nice P/E expansion over the year, pushing prices to new highs. Granite Group sees the market continuing its upward path next year, however not at the pace we have seen this year.

Granite Group wants to wish you all a Happy Holiday Season, a Merry Christmas and a joyous New Year!!!